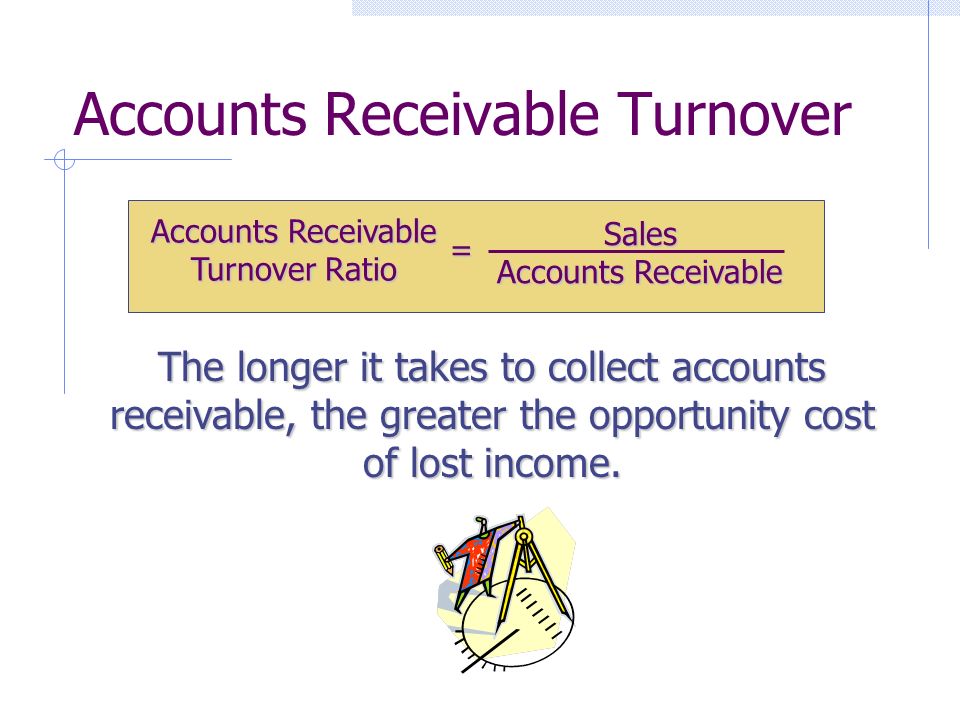

It most often means that your business is very efficient at collecting the money it’s owed. That’s also usually coupled with the fact that you have quality customers who pay on time. These on-time payments are significant because they improve your business’s cash flow and open up credit lines for customers to make additional purchases. Since you can never be 100% sure when payment will come in for goods or services provided on credit, managing your own business’s cash flow can be tricky. That’s where an efficiency ratio like the accounts receivable turnover ratio comes in.

Step 1: Determine your net credit sales.

For example, a company that has an accounts receivable turnover of 13.5 would indicate very efficient credit and collection processes, as it is collecting its receivables relatively frequently throughout the year. Use this accounts receivable turnover calculator to quickly determine how many times your company collects its average accounts receivable in a year. Now for the final step, the net credit sales can be divided by the average accounts receivable to determine your company’s accounts receivable turnover. Although this metric is not perfect, it’s a useful way to assess the strength of your credit policy and your efficiency when it comes to accounts receivables.

Accounts Receivable Turnover Ratio: Formula, Calculation, Examples

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

What is Accounts Receivable Turnover?

These professionals can help you manage your planning, policies, and answer any questions you have, about accounts receivable turnover, or otherwise. So, now that we’ve explained how to calculate the accounts receivable turnover ratio, let’s explore what this ratio can mean for your business. It means the company, on average, takes 60.83 days to collect a receivable. Whether this collection period of 60.83 days is good or bad for Maria depends on the terms of payment it offers to credit customers. For example, if Maria’s credit terms are 90 days, then the average collection period of 60.83 days is perfectly fine. But suppose, if its credit terms are 30 days or less, then an average collection period of 60.83 days would certainly be worrisome for the company.

Calculate receivables turnover ratio

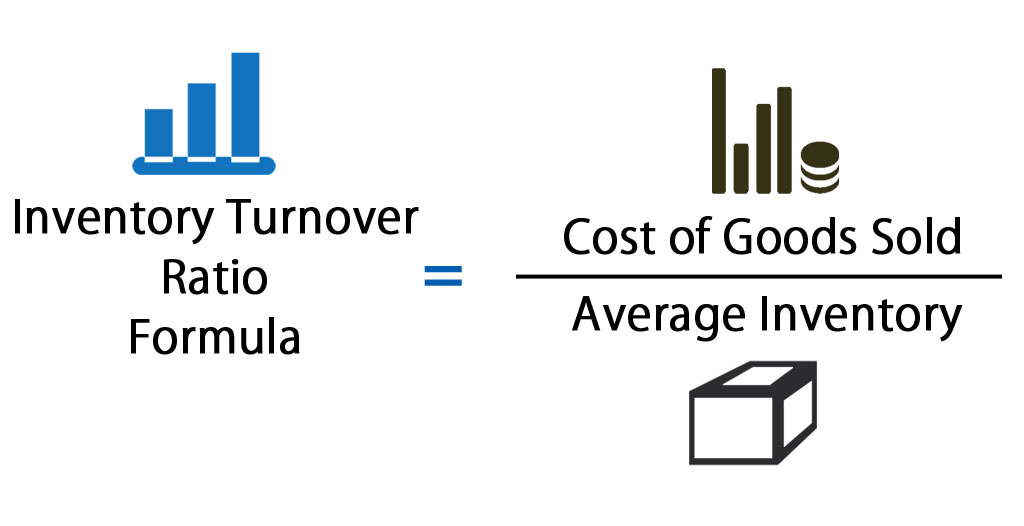

You should be able to find your net credit sales number on your annual income statement or on your balance sheet (as shown below). When it comes to business accounting, there are many formulas and calculations that, although seemingly complex, can nevertheless provide valuable insight into your business operations federal sales tax deduction and financials. One such calculation, the accounts receivable turnover ratio, can help you determine how effective you are at extending credit and collecting debts from your customers. The accounts receivable turnover ratio, or debtor’s turnover ratio, measures how efficiently your company collects revenue.

Conversely, a low ratio may signal inefficiencies or the need for strategic changes. However, it’s important to consider industry norms when evaluating this ratio, as asset utilization varies significantly across sectors. Using online payment platforms like Square or Paypal allows businesses to remove the need for collections calls and potential losses due to non-payments. While their might be upfront commission costs for these portals, it is important to consider the money and time that will be saved in the long run.

- But first, you need to understand what the number you calculated tells you.

- It’s important for a company to investigate the underlying causes and take appropriate actions to address the issue.

- Improving your Accounts Receivable Turnover ratio can make your business more efficient and financially stable, as you’re getting the money you need more quickly to run your operations.

- A strong relationship with your clients will help you understand their needs and demands, which might result in extending the credit period.

- The accounts receivable turnover ratio (A/R turnover) is a measure of how quickly a company collects its accounts receivable.

- All customers are billed a month in advance of service delivery, thereby preventing any customer from receiving services without paying the bill.

Accounts receivable are effectively interest-free loans that are short-term in nature and are extended by companies to their customers. If a company generates a sale to a client, it could extend terms of 30 or 60 days, meaning the client has 30 to 60 days to pay for the product. Since sales returns and sales allowances are outflows of cash, both are subtracted from total credit sales.

It provides insights into how effectively a company manages its receivables and ultimately generates cash from sales. In this comprehensive guide, we’ll take you through the steps on how to calculate AR turnover, its importance, and how to improve it for better cash flow. A high accounts receivable turnover ratio can indicate the high efficiency in debt collecting, quality customers and conservative credit policy, and sometimes it also means that the company majorly operates on a cash basis. The accounts receivable turnover ratio is one metric to watch closely as it measures how effectively a company is handling collections. If money is not coming in from customers as agreed and expected, cash flow can dry to a trickle.

With 90-day terms, you can expect construction companies to have lower ratio numbers. If you’re in construction, you’ll want to research your industry’s average receivables turnover ratio and compare your company’s ratio based on those averages. If you are an investor considering investing in a company, you should check its account receivable turnover ratio and look for a high ratio. Generally, a high ratio will be an indicator that the company has a good credit policy and good customer base, which means a high probability that your investments will be safe and hopefully start growing. It measures the value of a company’s sales or revenues relative to the value of its assets and indicates how efficiently a company uses its assets to generate revenue.

This income statement shows where you can pull the numbers for net credit sales. 80% of small business owners feel stressed about cash flow, according to the 2019 QuickBooks Cash Flow Survey . And more than half of them cite outstanding receivables as their biggest cash flow pain point. But nearly half of them claim those cash flow challenges came as a surprise. Managers should continuously track their entity’s receivables turnover ratio on a trend line to observe the gradual ups and downs in turnover performance.